Investing for your kids is a long-lasting investment in their future.

Investing for your kids is a long-lasting investment in their future.

Buying meaningful gifts for children can be challenging sometimes.

So, what about a special financial gift that will keep on giving for many years to come? In fact, beyond the monetary aspect, it’s a gift that should impart important lessons that can last a lifetime.

To get the most out of this gift, you’ll could also commit to a long-term regular investment program on behalf of your child or children.

Think of it as a long-lasting investment in their future.

The gift of compounding returns

Investing is primarily about generating a return on your capital outlay.

A return can be achieved in a number of ways, including via capital growth, regular income, and through compounding.

“Money makes money. And the money that money makes, makes money,” noted the famous American scientist and inventor, Benjamin Franklin (1706 – 1790), when explaining the power of compounding investment returns.

Put simply, as an investment balance increases over time, the investment returns generated off the higher investment balance will also increase.

The best way to illustrate this is by using a real-life example. This scenario is based on a parent having set up an investment account on behalf of a child on 31 October 2004, with a starting balance of $100.

The parent invested through the minor’s account into the Vanguard High Growth Index Fund and then made ongoing $100 monthly investments into the same account.

The Vanguard High Growth Index Fund is a managed fund that’s essentially a ready-made investment portfolio incorporating seven different Vanguard index funds. It invests in a broad mix of Australian and international shares and fixed-income securities.

The numbers quoted are based on the actual returns, after management fees but before tax, generated by the Vanguard High Growth Index Fund over the 18-year period from 31 October 2004 to 31 October 2022.

Importantly, to demonstrate the combined benefits of regular investing and compounding returns over time, they assume that all distribution payments from the managed fund were reinvested back into buying additional fund units.

Although the share market is prone to short-term volatility, over the longer term the share market has delivered strong growth for investors. For a child, what happens in the short term will have little bearing on their long-term capital returns.

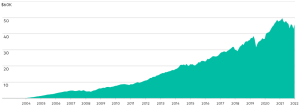

Vanguard High Growth Index Fund – $100 Monthly Contributions

By the end of year one, after making $1,200 of regular investments, you can see from the chart that the child’s account balance had grown minimally.

However, the longer-term benefits of compounding returns are better demonstrated from the end of year five. At that point, in October 2009, and after ongoing $100 per month contributions and the reinvestment of distributions, the child’s overall account balance had grown to more than $6,000.

Fast-forward another five years, and by October 2014, the child’s account balance had just about reached $18,000. Then, through ongoing investments and as a result of higher compounding returns, the account balance surged to around $36,000 by October 2019 and to almost $46,000 by the end of October 2022.

Not a bad profit (around $24,000, or 112 per cent), based on a total of $21,600 in monthly contributions made over 18 years.

This return was despite several prominent market blips – namely, the downturns on global financial markets over 2008 and 2009 stemming from the Global Financial Crisis and the impact on markets from the outbreak of the COVID-19 pandemic in early 2020.

The gift of financial education

When it comes to investing, and more particularly to achieving investment success, knowledge is key for both adults and children.

Involving your children throughout any investment process you take on their behalf can be invaluable.

As well as teaching them the basics of investing, having a long-term investment plan and framework will show them the benefits of strategies such as making regular investment contributions to increase compounding returns.

It will also teach them about the benefits of staying the course over the long term and not being distracted by short-term market events and volatility.

How much you invest and how often you invest on a child’s behalf is entirely up to you. That ultimately comes down to what you can afford to invest.

Set an affordable ongoing investment amount into your regular spending budget for each child. Even small amounts will grow over time when combined with compounding investment returns.

Of course, to achieve the full benefits of making regular contributions and from compounding returns on behalf a child, the earlier you start investing for them the better.

They’re lessons that they can take with them too as they grow as children, as they move into adulthood and start investing in their own right to continue building personal wealth, and that they can eventually pass on to their own children.

Personal Investor Kids

Vanguard’s Personal Investor Kids accounts are designed to give children under the age of 18 the best chance of investment success over the long term.

They enable adults who are Personal Investor clients to make regular automated investments using Auto Invest, starting from as little as $25 per fortnight, month, or quarter. Personal Investor Kids accounts also allows one-off investments to be made directly into a child’s account.

Personal Investor Kids provides access to Vanguard’s four ready-made diversified managed fund portfolios – the Vanguard High Growth Index Fund, Vanguard Growth Index Fund, Vanguard Balanced Index Fund, and Vanguard Conservative Index Fund.

To discuss setting your children up for financial freedom, get in touch, and we will create a strategy that suits your family.

Source: Vanguard